Companies often invest cash into the latest software and software development services, looking to boost company profits. But without tracking ROI (return on investment), it’s easy to waste money.

In this article, we’ll cover what tech ROI is, how to measure it correctly, and the benefits you’ll see when you invest in the right tools. You’ll also get practical tips to get more value from your tech investments.

What Is Technology ROI?

Technology ROI measures the financial and operational impact of any company’s tech investments. It compares the gains from tech adoption to its costs and helps businesses assess profitability. It also helps determine how efficient the business is with its tech.

Why it’s important in today’s business landscape

Every company wants to make smart investments, but technology spending can be hard to measure. Leaders need to know whether a new platform, software, or system improves efficiency, increases revenue, or cuts costs. Without proper ROI analysis, businesses risk wasting resources on tech that doesn’t deliver real value.

Having clear KPIs that help accurately measure ROI helps organizations justify upgrades, retire outdated systems, and stay competitive. It keeps businesses from falling behind or overinvesting in tools that won’t generate long-term returns.

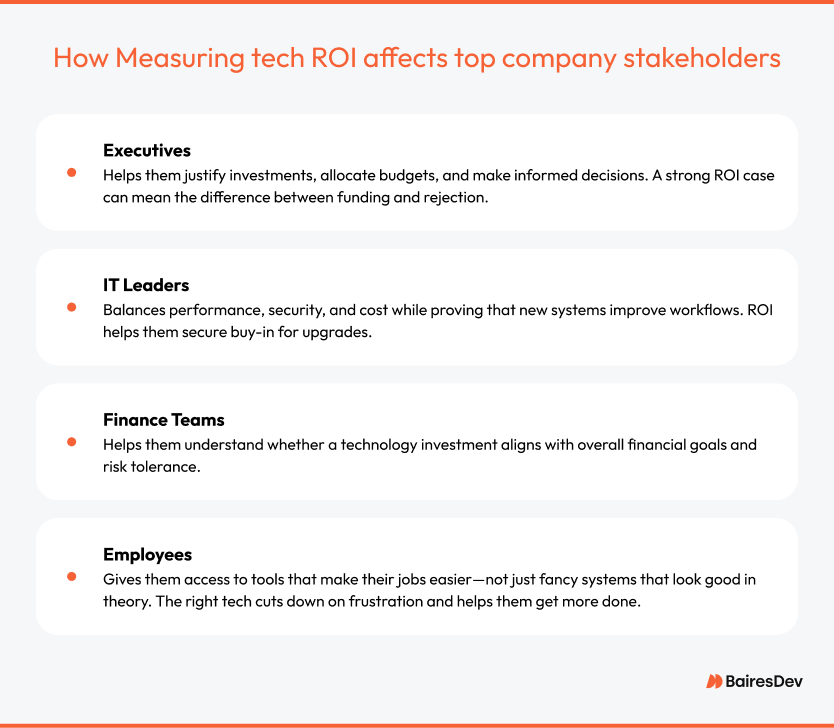

Measuring tech ROI also affects the top company stakeholders in the following ways:

Basic formula and calculation method

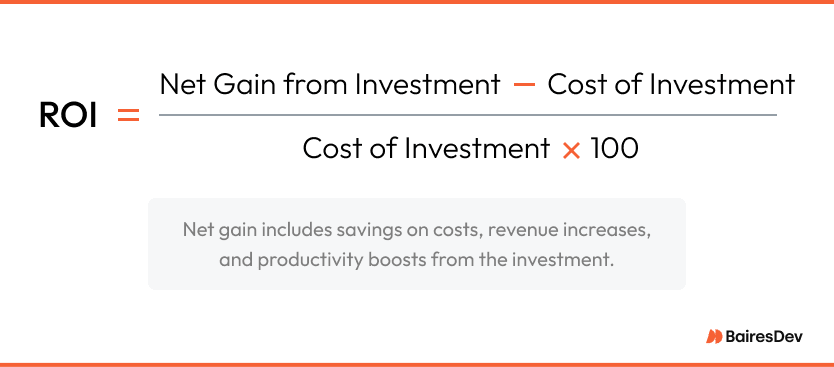

We talked about why it’s important to measure ROI of tech investments, but how do you do it? At its core, ROI is a simple equation:

A positive ROI means the technology delivers value, while a negative ROI suggests it costs more than it’s worth. This definition will give you the idea of how ROI is calculated, but we will get into a more detailed calculation method later in the article.

Different timeframes for measuring ROI

Keep in mind that not all technology investments pay off immediately. Some provide quick wins, while others take time to show real impact. Here are the time frames to consider when calculating ROI:

- Short-term ROI: This is often measured in months. It applies to tools that cut costs, speed up processes, or boost sales quickly. Examples include automation software that reduces manual work or e-commerce tools that increase conversions.

- Long-term ROI: This can take years to materialize. Think of infrastructure upgrades, AI-powered analytics, or ERP systems. These require upfront investment but pay off over time through efficiency gains and better decision-making.

When you invest in a new technology, remember to determine whether it will have a short-term ROI or a long-term ROI before deciding whether the tech is worth it.

Industry-specific benchmarks and expectations

Tech ROI numbers also vary across industries. What’s considered a success in one sector might be underwhelming in another. Here’s a closer look at what this means for retail, healthcare, manufacturing, and finance:

- Retail: Focuses on revenue growth, higher conversion rates, and customer retention. E-commerce platforms and personalized marketing tools often drive ROI here.

- Healthcare: Measures ROI through efficiency, cost savings, and improved patient outcomes. Electronic health records (EHRs) and telemedicine platforms would be in this category.

- Manufacturing: Looks at productivity, waste reduction, and supply chain issues. Investments in automation, IoT, and predictive maintenance should be considered.

- Finance: Prioritizes security, fraud prevention, and operational efficiency. Banking software and AI-driven risk analysis tools contribute to ROI in this sector.

Financial vs. non-financial returns

Another critical point to remember is that not all ROI is tied to direct profit. Some benefits improve operations, customer satisfaction, or employee productivity without an immediate financial return.

Financial returns are the easiest to quantify and often drive investment decisions. Cost reductions, increased sales, and higher margins all contribute directly to a company’s bottom line, making them key considerations in any ROI assessment.

Non-financial returns, while harder to measure in dollars, play a crucial role in long-term success. Improved user experience, stronger security, better compliance, and enhanced brand reputation can all create lasting value, even if the impact isn’t immediately visible on a balance sheet.

A solid ROI assessment looks at financial and non-financial factors to fully understand whether a technology investment makes sense.

Key Benefits of Technology Investments

Technology plays a role in business efficiency and lowering costs. It also improves your company’s competitive position. Here’s how the right investments deliver value:

- Work smarter. Automating mundane tasks and workflows means more time for strategic decison-making.

- Improve productivity. Give your team the tools they need to work faster, collaborate more, and get more done — make it easy!

- Get products out the door faster. Shorten development and testing cycles so your latest ideas hit the market before the competition does.

- Make customers happy. Better service, faster response times, and more personalized experiences lead to loyal customers and higher satisfaction scores.

- Cut costs without cutting corners. Eliminate inefficiencies, reduce waste, and make better use of resources to keep expenses in check.

- Improve quality across the board. With better data, automation, and real-time monitoring, you’ll reduce errors and maintain higher standards.

- Stay compliant (without the stress). Keep up with regulations by tracking and documenting requirements to avoid legal headaches down the line.

- Outpace the competition. The right tech helps you move faster, make smarter decisions, and stay ahead in your industry.

If you are experiencing the benefits listed above, you’re likely also seeing a positive ROI. Be sure to include both financial and non-financial benefits in your ROI calculation to get a complete picture.

Comprehensive ROI Calculation Methodology

Earlier, we covered the basic ROI calculation, but there are so many different factors that contribute to whether an investment is worth it or not.

A full ROI calculation captures the full scope of an investment, including direct expenses, hidden costs, tangible returns, and harder-to-measure benefits. It also accounts for time and risk, helping businesses make smarter long-term decisions. Here are some of the additional things to consider:

Identifying all relevant costs

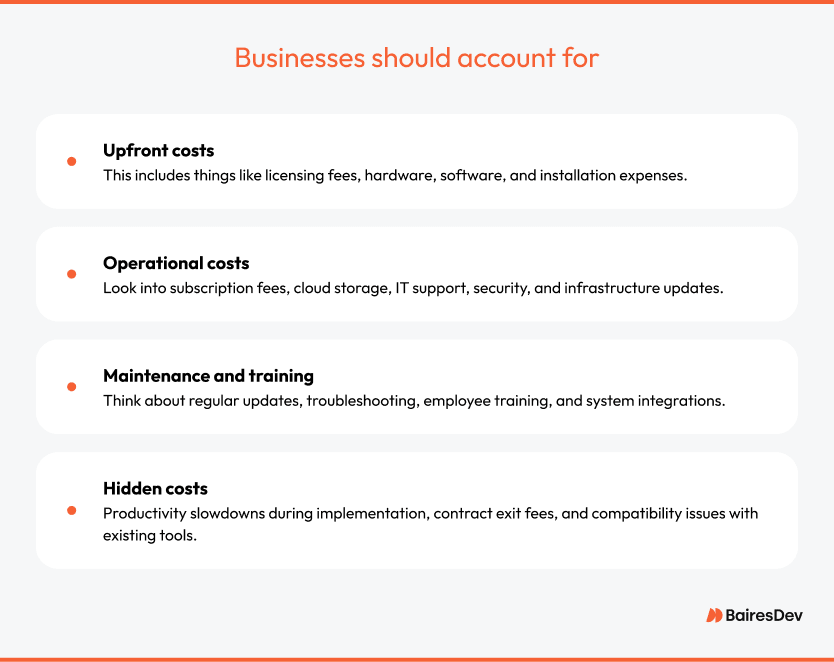

The initial purchase price is just the starting point. Technology investments come with layers of expenses, and missing even one can throw off an ROI calculation. Businesses should account for:

By mapping out every cost, businesses avoid unexpected surprises and get a clearer picture of whether an investment makes sense.

Quantifying tangible benefits

Some returns are easy to measure. If a company adopts an automation tool that cuts manual work by 50%, the savings are straightforward. The same applies to:

- Increased sales from better data insights

- Lower customer churn due to improved service

- Fewer errors lead to reduced rework and compliance fines

- Shorter production cycles that allow faster delivery

These numbers feed directly into ROI calculations, making it easier to justify spending and compare different options.

Approaches to measuring intangible benefits

Not every return shows up on a balance sheet, but that doesn’t mean it doesn’t matter. A new system might improve customer experience, strengthen a company’s reputation, or make employees happier. These benefits can be harder to quantify, but they still affect the bottom line.

Here are some ways you can measure them:

- Customer satisfaction scores: Higher Net Promoter Scores (NPS) or lower complaint volumes indicate a system improves service.

- Employee engagement: Faster, more intuitive tools can make your employees more productive and decrease potential turnover.

- Brand perception: Companies investing in sustainability or data privacy tech may attract more customers who care about ethical business practices.

While intangible benefits don’t always have a dollar amount attached, businesses can still track trends and correlate them with financial performance.

Time value of money considerations

Today’s dollar isn’t worth the same as a dollar five years from now. ROI calculations should adjust for the time value of money (TVM) by discounting future gains to their present value.

To account for this, businesses rely on key financial metrics:

- Net present value (NPV): The NVP determines the current worth of future cash flows by applying a discount rate.

- Internal rate of return (IRR): This helps businesses compare different investments by identifying the discount rate that brings NPV to zero.

These calculations help businesses see whether long-term benefits outweigh the upfront cost. A project might show a strong return on paper, but if the gains take a decade to materialize, it may not be worth the investment.

Risk adjustment techniques

Technology investments also carry risk. Adoption rates may be lower than expected, implementation could take longer than planned, or a competitor might introduce a better alternative. Risk adjustments help businesses prepare for uncertainty and set realistic expectations.

Ways to factor in risk include:

- Sensitivity analysis: Tests how different scenarios—best case, worst case, and most likely—affect ROI.

- Monte Carlo simulations: Runs thousands of potential outcomes to determine the probability of different ROI levels.

- Risk-adjusted discount rates: Higher-risk projects get higher discount rates to reflect the uncertainty of future returns.

Companies that account for risk upfront avoid costly miscalculations and make better long-term decisions.

Common Challenges in Technology ROI Calculation

Measuring ROI for technology investments can be challenging. Some benefits are easy to track, but others are harder to quantify. When you miscalculate ROI, it can lead to wasted spending, stalled decision-making, or missed opportunities. In fact, only 36% of marketers feel confident in their ability to measure ROI accurately. This shows how challenging it can be across industries.

Here are some of the biggest hurdles companies face when calculating ROI—and how to work around them:

- Difficulty quantifying benefits: Things like stronger brand perception or higher employee satisfaction are hard to measure, but they still matter. Businesses can track customer satisfaction scores, employee retention rates, and productivity gains, and compare those trends to financial performance.

- Accounting for all relevant costs: It’s easy to focus on the purchase price while missing long-term expenses. Companies should factor in licensing, maintenance, upgrades, integration, and training. You should even consider indirect costs like lost productivity during implementation.

- Attribution problems: When multiple initiatives run at the same time, it’s hard to tell which one drives results. A/B testing, pilot programs, and controlled rollouts can help separate the impact of a specific investment from other changes.

- Changing technology environments: How fast (or slow) you innovate makes long-term ROI harder to predict. Businesses that invest in flexible, scalable systems—rather than rigid, one-size-fits-all platforms—avoid early obsolescence and maximize their returns over time.

- Organizational resistance to measurement: Some teams hesitate to track ROI because they worry it could expose failed projects or justify budget cuts. The best thing to do is shift the team’s focus from blame to improvement. This encourages teams to measure results well and use data to make better decisions.

Companies that take a structured approach to ROI—one that includes financial gains, strategic value, and long-term sustainability—make smarter investments, cut unnecessary spending, and position themselves for stronger growth.

Technology ROI for Different Business Functions

Tech spending can transform almost every corner of your business. Knowing which investments pay off helps you decide where to put your money and whether you should invest in digital transformation. Let’s break down how tech can boost different parts of your company:

IT infrastructure investments

When you invest in digital transformation, swap out those old servers, and update your network gear, everything runs faster and crashes less often. Some real-world proof: software companies that upgraded their tech backbone saw nearly 19% returns last quarter. This is way better than what most businesses get from their investments.

Software development projects

When you build software specifically for your business instead of using off-the-shelf programs, you get exactly what you need. Companies that take this route work more efficiently and pull ahead of competitors. The numbers back this up, too. Businesses typically see their software investment multiply nearly four times over three years. That’s about 41% yearly returns, which beats almost any other investment you could make.

Automation of digital transformation initiatives

Implementing automation technologies makes repetitive tasks easier, reduces errors, and frees up employees for more strategic activities. While specific digital transformation ROI figures vary, companies often see significant cost savings and productivity gains from automation projects.

Data and analytics investments

Using data analytics helps businesses make informed decisions, identify market trends, and personalize customer experiences. A successful data management program can yield a 348% actual ROI over three years, with a payback period of less than six months.

Cybersecurity expenditures

Investing in cybersecurity measures protects organizations from data breaches and financial losses. In 2023, the average cost of a data breach was $4.45 million, underscoring the importance of robust security investments.

Make Smarter Technology Investments

Measuring technology return on investment helps businesses make decisions that drive growth, cut unnecessary costs, and improve efficiency. Companies that track both direct financial returns and strategic value can avoid wasted spending and focus on investments that deliver real impact.

BairesDev helps businesses build custom technology solutions designed for measurable success. Whether it’s modernizing infrastructure, automating workflows, or developing software that supports long-term growth, every project should have a clear return. An actual ROI strategy means setting benchmarks early, choosing scalable solutions, and using data to guide decisions.

Technology investments shouldn’t be a guessing game. Companies that approach them with a structured ROI mindset gain the insights needed to move faster, optimize spending, and stay ahead of competitors. BairesDev delivers the expertise and execution that make those investments worthwhile.