You have an amazing idea for an app and are ready to put it into action. But so do hundreds of thousands — if not millions — of other great entrepreneurial minds.

As you probably already know, creating a great app requires money. Your ability to secure that money can make or break your entire vision and concept. In order to get your app at the top of the Apple App or Google Play stores, you’ll need to attract investors to it.

Every app started out as an idea, but what separates the successful ones from those that failed isn’t just the quality of that app — it’s also factors like marketing, pitching, and backing. So, how do you give your concept a chance to become the next Instagram?

Funding Rounds

Before we dive into specific methods for attracting investors, it’s important to outline the rounds of funding that go into the development of any early product or startup.

Seed/Angel Round

The early stages of funding are called pre-seed, seed, or angel rounds. This money comes from your first investors, often people within your network. They can also come from the more formal process of securing angel investors or venture capitalists.

Series A

In this round, you’ll secure larger-scale venture capital (VC) funding — usually millions of dollars. This will allow you to further develop your idea.

Series B, C, etc.

Sometimes, businesses will have additional rounds, depending on their previous funding success and specific needs. This funding will allow you to grow and improve your product and business.

Pitching Your Product

Hone Your Target Audience

In order to make your product successful, you’ll need to define your target audience. You should also ensure there’s a demand for an app like yours. With so much competition on the market, it’s critical to narrow your focus to pinpoint who will use your product and why they would choose it over a similar one. You should do this regardless of the industry you’re in, as this is a basic business strategy.

This will require extensive research on the part of you and your partners in the business venture. Find out what apps exist that are similar to yours and identify the reasons why they fall short in comparison to yours. This will help you see what market gap you can address.

You should also develop a solid idea of the kind of person that would want an app like yours so you can gear your marketing and branding accordingly, as well as successfully pitch it to would-be investors.

Market Effectively

Once you’ve identified your niche and clarified your audience, you should come up with ideas of how to market your app so that it reaches its goal users. This isn’t just useful for ultimately selling your product — it will also show your prospective investors how you can successfully reach your audience.

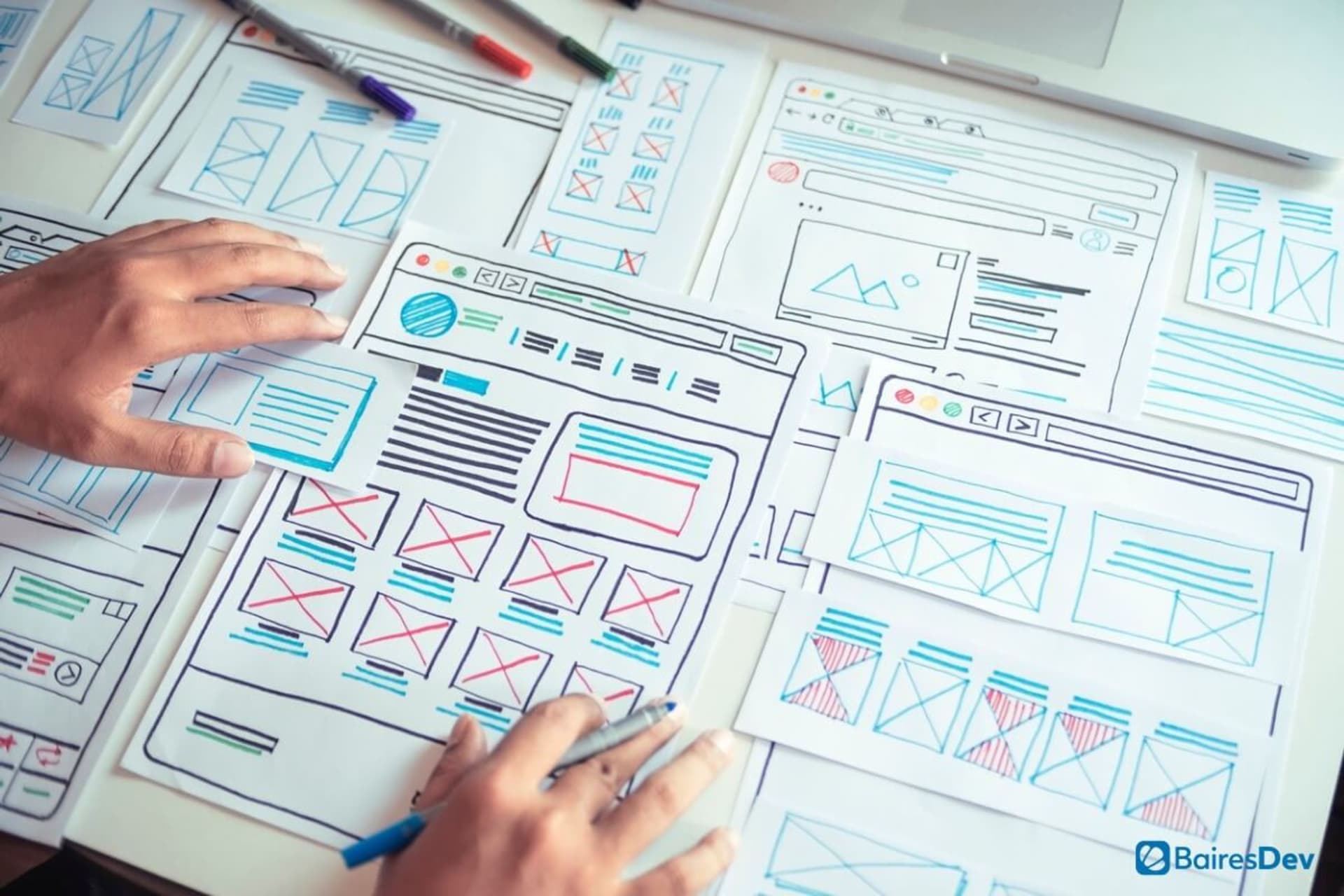

Branding involves concepts such as design, mockups, and logo creation. It will give others a way to envision how your app will be presented and encourage them to have a clear picture in their mind of what your app will ultimately be.

Develop Your Presentation

Two of the most critical parts of your presentation are your elevator pitch and your pitch deck. The elevator pitch is a concise speech that succinctly sums up your idea. Remember: investors are incredibly busy, so you need to grab their attention immediately. Your pitch should be roughly 30 seconds, and in that short amount of time, you should be able to “hook” them. In fact, its name comes from the brevity you’ll need to pitch a convincing idea to someone sharing an elevator with you.

Once you’ve secured a sit-down meeting with an investor, you can get into more of the nitty-gritty of your app. To guide your presentation, you should create a pitch deck. This is a visual slideshow that will reveal key information and data about your product, helping investors clearly see what you’re discussing in your oral presentation.

Create an MVP

A minimum viable product (MVP) is essentially a rudimentary version of your app. This is something you can show investors to demonstrate that you’ve made real headway on your product and that it’s more than just an idea. Your MVP will also allow them to actually try out your app. While this probably won’t be your end product, it gives investors a good idea of what the foundation looks like.

Finding Investors

Look to Your Circle

In the seed round, much of your funding will probably come from your personal network, unless you’re an established company with access to larger venture capitalists. If you’re like many early-stage startup entrepreneurs, however, you’ll probably be looking to friends and family for small investments. Your circle could also include people you may not know personally but share affiliations with, such as alumni from your college or members of your community.

Just because you know these people or have mutual acquaintances doesn’t mean you don’t still have to sell them on your idea. As you would with any investor, have a solid presentation and make your case as to why this is a sound investment. Since these people are trusting you, use their money purposefully and wisely.

Start a Crowdfunding Campaign

Crowdfunding typically helps you secure small amounts of money from a large number of people, depending, of course, on the success of your campaign. You’ll have to have top-notch branding and a great pitch in order to stand out against the many other campaigns on platforms like Kickstarter, but if you’re successful, you’ll not only secure funds but also spread the word about your app.

Consider Contests

Many startups participate in contests to secure funding for their apps. During these events, you’ll compete against other startups. There are many opportunities out there, such as TechCrunch Disrupt. Depending on the size of the contest and sponsor, the prize can vary significantly in terms of the amount of money you’ll be awarded. Another perk of these competitions is that they’re a great networking opportunity, even if you don’t win.

Look to Angel Investors

Angel investors typically invest during the angel/seed round. They are successful, third-party individuals or organizations that typically offer large amounts of money in exchange for equity.

To find angel investors, you can look on platforms like AngelList. You should do some research on potential investors to find out their main areas of interest, at what stage they typically invest, and the average size of their investments.

Keep in mind that you’re not limited to these sources of funding. While they are always great paths to securing investments for your app, you should always be creative when searching for investors for your app. Since they’re critical to making your vision a reality and getting your product into the hands of users, every little bit counts.